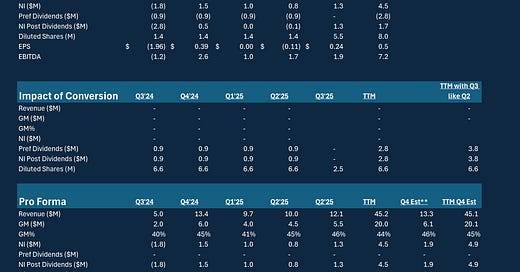

The thesis is straightforward: I believe the company is on track to generate approximately $0.90 per share in EBITDA for FY25. Note that MIND follows a unique fiscal year structure, so this refers to the current fiscal year. At a $13.50 stock price, the valuation would equate to roughly 15x EV/EBITDA, which is in line with the S&P 500’s multiple as of December 2024. This suggests that MIND could trade at $13.50 per share while still being reasonably priced relative to the broader market.

Granted, applying the S&P 500’s multiple to a microcap stock presents challenges. However, MIND stands out for several reasons that differentiate it from the average S&P 500 company:

No Debt: An uncommon advantage, especially for a company of this size.

~35% Year-Over-Year Revenue Growth: A robust growth rate that significantly outpaces the broader market.

Acquisition Potential: A private equity firm or strategic buyer could enhance margins and unlock operational synergies.

These attributes make a compelling case for MIND, positioning it as a unique investment opportunity despite its microcap status.

Now, the Math…

Disclosure: I am long. I did sell some recently. And do plan to sell more as this goes higher as I am overweight.